Investing in real estate is a significant decision that requires careful planning, research, and consideration. When investing in the Macarthur region of New South Wales (NSW), Australia, several factors must be considered. This blog post will guide you through what to look for when investing, how to choose a good property investment, how to evaluate the area and the process of buying an investment property.

Understanding The Macarthur Region

The Macarthur is a vibrant and growing region in the metropolitan area of Sydney, NSW. It is known for its rich history, cultural diversity, and a strong sense of community. The area offers a mix of residential, commercial, and industrial properties, making it an attractive location for investors.

The Current Market Conditions

The property market in the Macarthur region, NSW, has been showing promising signs for investors. Over the past year, rental yields across the region, which includes Campbelltown, have seen an average increase of approximately 0.8%, bringing the average rental yield to around 3.4%. This is a significant figure, especially when compared to other areas, and indicates an increasing return on investment for property owners.

Property prices throughout the region have also shown impressive growth. Over the past decade, prices have typically doubled, demonstrating the area’s substantial capital growth potential. Despite decreases in other areas throughout Sydney, property prices in the Macarthur region remain strong, suggesting a robust and resilient market.

One of the key indicators of a healthy investment property market is the vacancy rate. In the Macarthur, vacancy rates are low – there is high demand for rental properties with low quantities of rental properties available to rent. This is a positive sign for investors, as a low vacancy rate means properties are less likely to sit empty, leading to a consistent rental income.

Furthermore, Macarthur’s property market is expected to see a good amount of stock coming onto the market. This benefits investors as it provides a wider range of options for investment and the opportunity to negotiate better purchase prices.

The combination of strong rental yields, robust property prices, low vacancy rates, and a good amount of stock predicted to come onto the market makes the Macarthur region an excellent location for property investors. The area offers good capital growth potential and rental return, making it an attractive option for those looking to invest in the property market.

Examples of Median Property Prices vs No of Houses Sold in Campbelltown & Surrounding Areas:

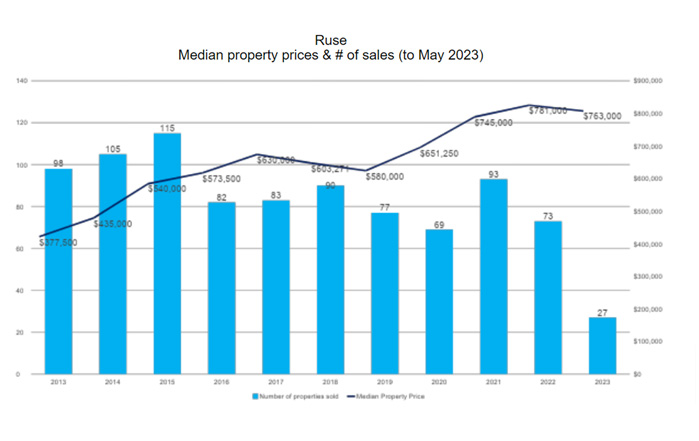

RUSE:

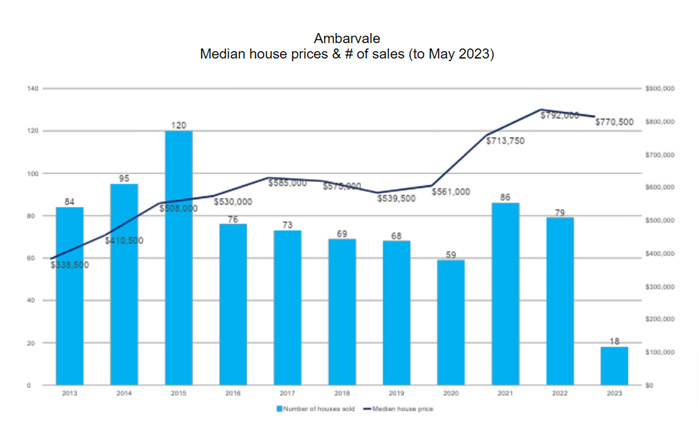

AMBARVALE:

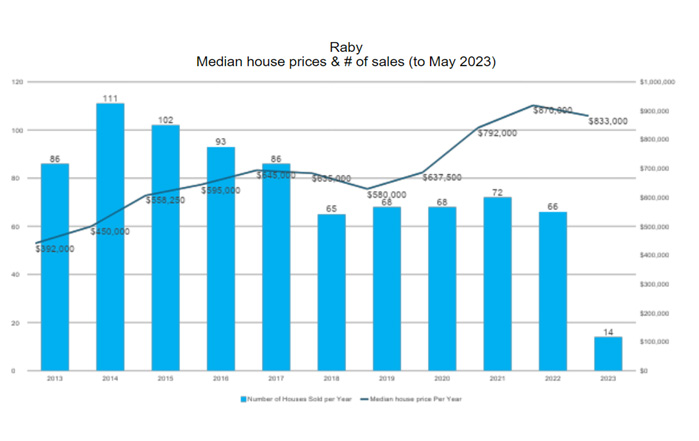

RABY:

GLEN ALPINE:

What to Look for When Investing in Property

Location: The location of a property is crucial as it determines its desirability and potential for growth. Investors should look for properties in areas with strong economic fundamentals, such as low unemployment rates, good infrastructure, proximity to amenities, and potential for future development.

Market Trends: Investors should consider factors like property price trends, rental demand, vacancy rates, and the overall economic outlook to gauge the potential for capital appreciation.

Rental Income: The potential rental income is an important consideration for property investors. Investors should evaluate the current rental rates in the area, vacancy rates, and the potential for rental growth in the future. This analysis helps determine the property’s cash flow and return on investment (ROI) potential.

Property Type and Condition: Investors should assess the type of property (residential, commercial, industrial, etc.) and its condition. Investors should consider factors like property’s age, structural integrity, maintenance requirements, and any potential renovation or improvement costs. Properties in good condition and with low maintenance requirements are generally preferred.

Financing Options: Investors should evaluate the financing options for purchasing the property. Investors should consider interest rates, loan terms, down payment requirements, and the potential for leveraging their investment. Financing terms can significantly impact the affordability and overall profitability of the investment.

Cash Flow Analysis: Investors should conduct a detailed cash flow analysis to determine the income potential and expenses associated with the property. Investors should consider rental income, property taxes, insurance costs, property management fees, maintenance expenses, and other operating costs. Positive cash flow is often a key consideration for investors.

Potential for Appreciation: Property investors should analyse the potential for value appreciation over time. Investors should consider factors such as planned infrastructure developments, rezoning, gentrification, and other catalysts that could impact property values in the area.

Risk Assessment: Investors should assess the risks associated with the investment, including factors like market volatility, economic conditions, tenant turnover, regulatory changes, and potential liabilities. Investors should aim to identify and mitigate any risks to safeguard their investment.

Exit Strategy: Investors should also consider their exit strategy for the property. They analyse factors like the potential resale value, market liquidity, and the ease of selling the property when they decide to exit the investment.

Evaluating the Area

- Demographics

Understanding the demographics of the Macarthur region can help you predict future demand for properties. Look at factors like population growth, age distribution, and income levels. For example, investing in apartments or townhouses might be a good idea if the area has a growing population of young professionals..

- Infrastructure and Development

Look at the current and planned infrastructure in the area. New roads, public transport links, schools, or shopping centres can increase the area’s appeal and lead to property price growth. Also, consider any planned developments that could impact the supply of properties in the area.

- Rental Yields and Vacancy Rates

Rental yield is a key indicator of a property’s potential return. It’s calculated by dividing the annual rental income by the property’s price. A high rental yield can indicate a strong demand for rental properties. Similarly, a low vacancy rate can suggest that rental properties are in high demand.

The Process of Buying an Investment Property

- Finance Pre-Approval

Before you start looking for properties, getting pre-approved for a loan is a good idea. This will give you a clear idea of your budget and show sellers that you’re a serious buyer.

- Property Search and Evaluation

Once you have your finance pre-approved, you can start looking for properties. Use the criteria discussed above to evaluate potential investments. Consider hiring a property investment consultant or a buyer’s agent to help with this process.

- Making an Offer and Negotiation

Once you’ve found a property you’re interested in, you can make an offer. If the seller accepts your offer, you’ll enter into a contract of sale. You will also need to negotiate the terms of the sale, such as the settlement date.

- Property Inspection

Before finalising the purchase, it’s important to have the property inspected by a professional. This can help you identify any potential issues with the property, such as structural problems or pest infestations.

- Settlement

The final step in the process is the settlement. This is when you pay the purchase price balance, and the property’s title is transferred to you. You’ll also need to pay any stamp duty and other fees at this time.

Conclusion

Investing in property in the Macarthur region can be a rewarding venture if done correctly. By understanding the local market, evaluating potential investments carefully, and following the right process, you can increase your chances of success. Remember, property investment is a long-term commitment, so it’s important to make decisions that align with your financial goals and risk tolerance. Happy investing!

Please contact our office for a more comprehensive breakdown of all our research and access to all our Macarthur area data.