The Macarthur region in New South Wales (NSW) is a focal point for home ownership and investment.

Recent market trends indicate greater promise for investors, with property and rent prices rising; however, increased interest rates have kept this contained for now.

Changes with Government grants for First Home Buyers from 1st July 2023 have given these buyers more opportunity to get into home ownership, and we are seeing the effects in the market.

Currently, the Macarthur region is experiencing prices that are on the rise, plus a decrease in days on the market compared to last quarter. Now is an excellent time for homeowners to sell for a good price in this competitive market.

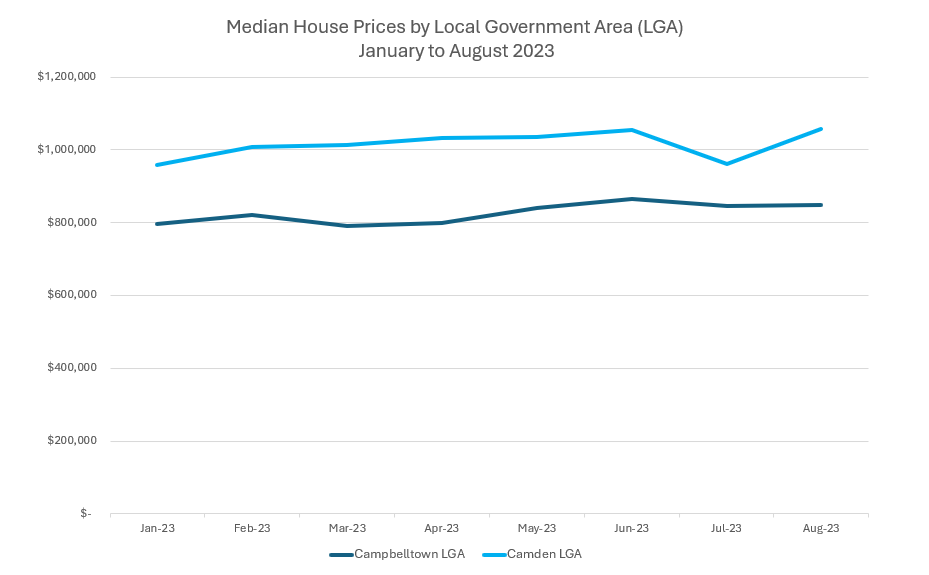

Since January this year, both Campbelltown and Camden Local Government Areas are experiencing an up-trend in median house price.

A Glimpse into Macarthur’s Real Estate Landscape

The Macarthur region, nestled in Sydney’s south-west, boasts a rich history, cultural diversity, and a tight-knit community. Its diverse property portfolio, ranging from residential to commercial and industrial spaces, makes it a logical choice for buying and investment.

Currently, the region boasts many new house and apartment developments, particularly in the suburbs of Rosemeadow, Campbelltown, Cobbitty, Spring Farm, Gregory Hills, Catherine Field, Menangle Park, Leppington, Gledswood Hills, Claymore, Wilton, Tahmoor, Gilead and Oran Park.

Recent market analyses reveal some encouraging signs

Rising Property Prices: Over the past decade, property prices in Macarthur have doubled, showcasing the region’s immense capital growth potential. More recently, even as some areas in Sydney witnessed a dip, Macarthur’s property prices remained resilient.

Decreased Days on Market: A noteworthy trend is the reduction in the number of days properties stay on the market compared to earlier in the year. This suggests that properties are in demand and are being snapped up faster by eager buyers.

Promising Rental Yields: The past year has seen an average increase in rental yields by approximately 0.8%, with the average yield hovering around 3.4%. This is an impressive figure, especially when juxtaposed with other regions.

Low Vacancy Rates: The Macarthur region has a low vacancy rate, indicating a high demand for rental properties. This translates to consistent rental income for investors, as properties are less likely to remain unoccupied.

Investing Smartly in the Macarthur

For those considering property investment in the Macarthur, here are some key pointers:

Location Matters: Ensure the property is situated in an area with robust economic indicators, such as low unemployment rates, good infrastructure, and potential for future development.

Stay Updated with Market Trends: Keep an eye on property price trends, rental demand, and overall economic outlook to gauge potential capital appreciation.

Evaluate Rental Income Potential: Analyse current rental rates, vacancy rates, and future rental growth prospects to determine the property’s ROI potential.

Inspect Property Type & Condition: Assess the property’s type and its current condition. Consider factors like age, structural soundness, and potential renovation costs.

Plan Your Exit Strategy: Always have an exit strategy in place. Consider potential resale value and market liquidity when planning to exit your investment.

In Conclusion

The Macarthur region, with its promising property market trends, offers a great opportunity for buyers and investors. As property prices rise and days on the market decrease, it’s evident that the Macarthur is becoming a hotspot for property purchasing and investment.

Please contact our office for more information and help with your property needs.